Finance Committee

A Finance Committee is a specialized sub-committee of a Board of Directors responsible for overseeing the financial health, stability, and strategy of an organization. Functioning as a bridge between the board and management, this committee provides detailed scrutiny of financial matters, ensuring that the organization remains solvent, financially sustainable, and aligned with its strategic objectives.

While the full board retains the ultimate liability for financial oversight under Australian law, the Finance Committee allows for a granular focus on budgeting, financial reporting, capital management, and investment strategies that is often not possible during standard board meetings.

The Strategic Purpose of a Finance Committee

In the Australian governance landscape, the Finance Committee plays a pivotal role in fulfilling the board's fiduciary duties. It acts as an advisory body, filtering complex financial data into actionable insights for the main board.

The primary purpose is not to manage the accounts—that is the role of the CFO and the finance team—but to provide governance and oversight. They ensure that the numbers presented by management reflect reality and that the financial trajectory supports the organization's long-term mission.

Key Objectives

-

Fiduciary Oversight: Ensuring resources are used efficiently and ethically.

-

Strategic Alignment: Verifying that the budget allocates funds to agreed-upon strategic priorities.

-

Financial Integrity: Safeguarding the accuracy of financial models and reports.

Core Roles and Responsibilities

The specific duties of a Finance Committee are defined by its Terms of Reference or Charter. However, in most Australian public, private, and non-profit entities, the responsibilities fall into the following categories:

1. Budgeting and Financial Planning

The committee reviews the annual operating budget and capital expenditure (CapEx) budget proposed by management. This involves:

-

Challenging assumptions made by management regarding revenue growth and expense control.

-

Ensuring the budget aligns with the organization's strategic plan.

-

Recommending the final budget to the full board for approval.

2. Financial Monitoring and Reporting

Once the budget is active, the committee monitors performance against it. They review monthly or quarterly management accounts to identify variances (significant differences between budgeted and actual figures).

-

Deep Dive: If a department is overspending, the Finance Committee investigates why before the issue escalates to the full board.

-

Forecasting: They review re-forecasts to predict the year-end financial position.

3. Capital Structure and Investment

For commercial entities, this involves decisions on debt and equity. For Not-for-Profits (NFPs), this involves reserve management.

-

Debt Management: Overseeing borrowing arrangements, covenants, and interest rate risk.

-

Investments: Approving investment policies and monitoring the performance of investment portfolios.

4. Solvency and Compliance

Under the Corporations Act 2001 (Cth), directors have a duty to prevent insolvent trading. The Finance Committee is the first line of defense in monitoring cash flow and liquidity ratios to ensure the company can pay its debts as and when they fall due.

5. Financial Policy Governance

The committee approves and reviews internal financial policies, such as:

-

Delegations of Authority (who can sign off on what amount).

-

Procurement and tendering policies.

-

Expense reimbursement policies for staff and directors.

The Australian Regulatory Context

Operating a Finance Committee in Australia requires adherence to specific regulatory frameworks and best practice recommendations.

The Corporations Act 2001

While the Act does not explicitly mandate a "Finance Committee" for all companies, it places strict duties on directors regarding care, diligence, and the prevention of insolvent trading (Section 588G). A functioning Finance Committee is often cited as evidence that directors exercised "reasonable care" in monitoring the company’s financial position.

ASX Corporate Governance Principles

For listed entities, the ASX Corporate Governance Council sets out recommendations. While Principle 4 primarily focuses on the Audit Committee, the principles regarding "Safeguarding the integrity of corporate reports" often overlap with the work of a Finance Committee. Many smaller listed companies combine these roles into an "Audit and Finance Committee."

ACNC Governance Standards (For Non-Profits)

For Australian charities, the Australian Charities and Not-for-profits Commission (ACNC) Governance Standard 5 requires that responsible persons ensure the charity's financial affairs are managed responsibly. A Finance Committee is the standard mechanism for demonstrating compliance with this standard in medium-to-large charities.

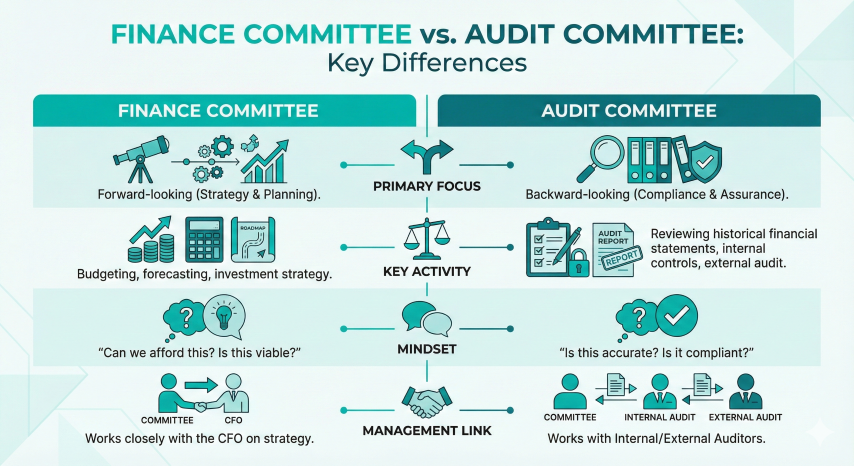

Finance Committee vs. Audit Committee

A common point of confusion in corporate governance is the distinction between the Finance Committee and the Audit and Risk Committee. While they both deal with numbers, their focus differs significantly.

Note: In smaller Australian organizations, these two committees are frequently combined to reduce the administrative burden on directors.

Committee Composition and Skills

To be effective, the Finance Committee must possess a high level of financial literacy.

1. The Chair

The Chair of the Finance Committee should ideally be a qualified accountant (CA or CPA) or possess significant financial management experience. They must be able to translate complex financial jargon into clear language for the rest of the board.

2. Independent Directors

Best practice suggests the committee should comprise a majority of independent non-executive directors. This ensures objective oversight of management's financial performance.

3. The Role of the CFO

The Chief Financial Officer (CFO) usually attends all meetings as the primary management representative. They present the reports and answer questions but generally do not have a vote, maintaining the separation between management and governance.

Best Practices for Finance Committees

To maximize value, Finance Committees should adhere to the following operational best practices:

Clear Terms of Reference (Charter)

The board must approve a clear Charter that outlines the committee's authority. It should specify what the committee can approve (e.g., unbudgeted spend up to $50,000) versus what it must recommend to the board.

Risk-Based Reporting

Rather than reviewing every line item, the committee should focus on high-risk areas. This is known as "reporting by exception," where attention is drawn only to significant variances or risks.

Utilization of Board Software

Modern governance relies on efficiency. Using board management software like BoardCloud allows the Finance Committee to:

-

Securely access sensitive financial documents prior to meetings.

-

Annotate budget spreadsheets digitally.

-

Maintain a searchable archive of past financial decisions and approvals.

Annual Review

The committee should conduct an annual self-evaluation to review its effectiveness and update its Charter to reflect changing economic conditions or organizational scale.

Frequently Asked Questions (FAQ)

Is a Finance Committee mandatory in Australia?

No, the Corporations Act 2001 does not explicitly mandate a standalone Finance Committee for private companies. However, for larger organizations, listed entities, and significant non-profits, it is considered a standard component of good corporate governance to ensure financial oversight duties are met.

Can the Finance Committee approve the budget?

Generally, no. The Finance Committee reviews and scrutinizes the budget in detail and then recommends it to the full Board of Directors for final approval. The full board retains the ultimate authority and liability for the organization's financial plan.

What is the difference between the Treasurer and the Finance Committee Chair?

In many Not-for-Profits, the Treasurer acts as the Chair of the Finance Committee. However, in larger commercial boards, the role of "Treasurer" rarely exists. Instead, a Non-Executive Director with financial expertise chairs the committee. The Treasurer is often an operational officer role, whereas the Committee Chair is a governance role.

How often should the Finance Committee meet?

This depends on the organization's cycle. Most committees meet monthly or bi-monthly, usually a week prior to the main board meeting. This timing allows the committee to digest financial reports and prepare a summary for the full board pack.